Our team recently talked to someone who was fed up with their payment provider.

They had just signed a new multi-year contract and completed a labor-intensive technical implementation. They were so dissatisfied that they reached out to one of our experts.

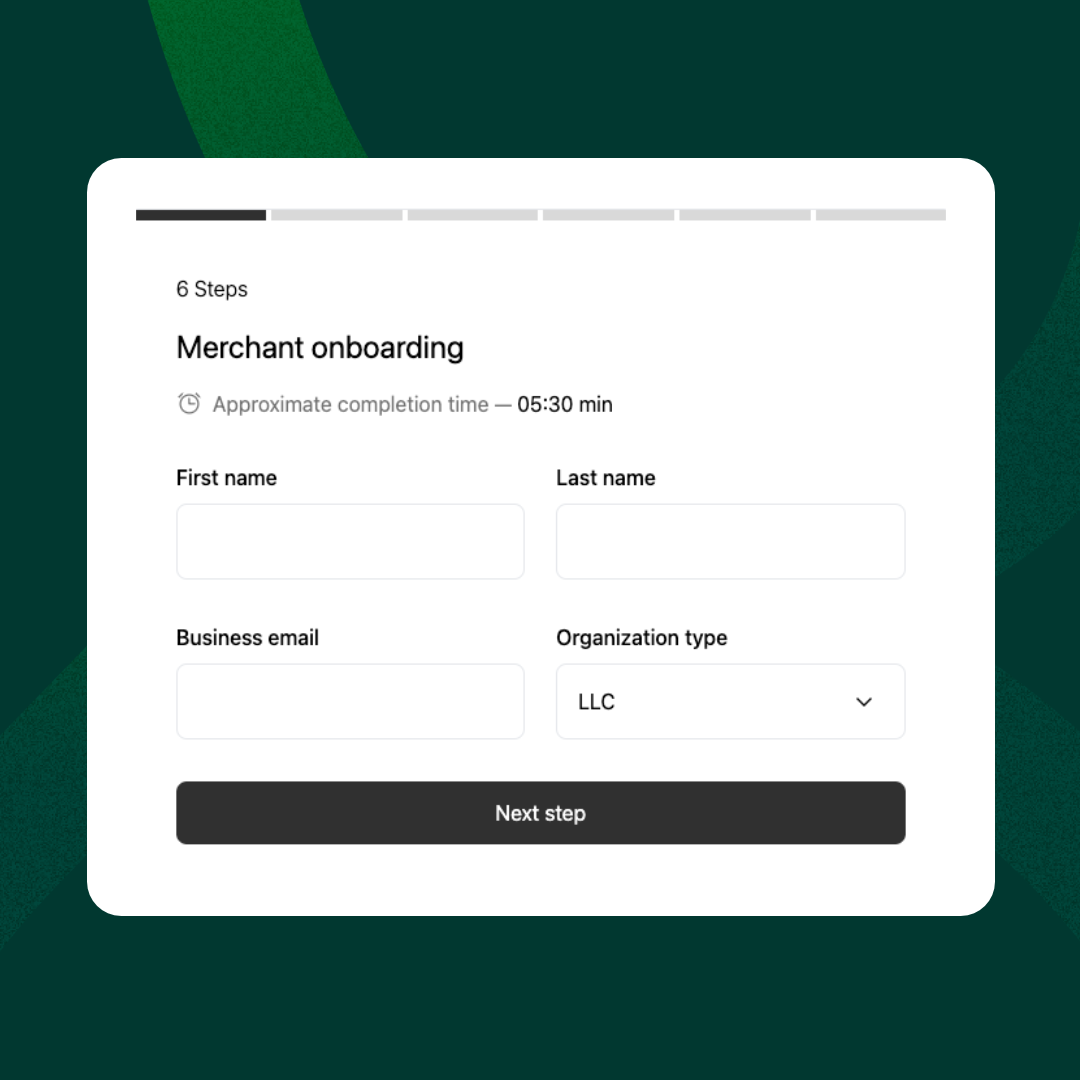

They were moving from an “integrated payments” model, where the platform was referring merchants to the provider and receiving a small commission, to an “embedded payments” model, where the platform owns the branding, merchant relationship, and payment experience.

The platform had specific goals:

- Increased monetization

- More control over merchant payouts

- Customizable reports to facilitate reconciliation

Here’s the reality…

Monetization

The platform expected to increase their residuals by 40-50 bps by switching to a fully embedded payments model. Their reality: ~ 5 bps

Why: higher card network passthrough costs (like Interchange) and litany of unexpected fees including a separate authorization fee that hadn’t been present in their previous agreement and higher-than-expected fees on payouts.

Payouts

Payments were unpredictable before the migration, and they are still unpredictable after the migration. The platform doesn’t have much more flexibility than they had before, and can’t control the timing of the payouts.

Merchants are still complaining, but now they’re complaining to the platform instead of the payment provider because under the new agreement the platform represents the payments product as being offered by themselves.

Reporting and Reconciliation

Although the platform now has control over the presentation of the reports, reconciliation is still problematic because the underlying data makes it difficult to tie fees and payouts back to specific transactions.

The problem persists at both the platform level and the merchant level.

The reporting and reconciliation deficiency also obscures the fee structure, making it difficult for the platform to verify whether or not they are being billed correctly.

Support

The platform reached out to their payment provider to discuss their concerns.

The payment provider deflected by asking about the platform’s monetization plan and attempted to upsell other new ancillary financial products.

Embedded payments WAS the platform’s monetization plan.

And, because they signed a long-term contract, the platform doesn’t have a lot of options.

The payment provider doesn’t really have to earn the platform’s business because the platform is already locked into a contract, and they both know it.

How can platforms avoid this? Choose a payment provider who earns your business every month instead of demanding exclusivity, monthly minimums, or a long-term contract.